Put on your oxygen mask before helping others

Over the next few weeks, we will offer a six-part bootcamp for taking your firm digital. We believe that you should focus more on digital marketing today. Not tomorrow. Today.

In the short-term, you can use email, social media, video conferences, and digital ads to help generate enough business to pull your firm through this crisis. In the long-term, the goal is to build a more profitable, valuable, and efficient practice.

However, before you try something new, you need to feel confident about your business today. In part 1 of 6 of our series, we’ll focus on how to shore up your financials in the middle of a pandemic.

Remember cash is king

Whoever can manage their cash flow will be more likely to survive and thrive in this weird world we now inhabit. To help you do this, you need to follow this simple rule: speed up money coming in the front door, slow down money going out the back.

So: how do you do this as an independent agent, producer, or financial advisor? First, just like you would with your client, start by creating a rough cash flow needs analysis.

Daily Burn Rate

Add the last six months of payments from all your business bank accounts and divide by the number of days in those months. Why go back six months? You will likely find that certain receivables may take a long time to turn into cash in your bank account. These may be annuities requiring 1035 exchanges or hard-to-place, and rated life insurance applications in the pipeline. This will give you an accurate daily burn rate for your practice.

Cash On Hand

Add up all your current bank balances and cash holdings that you can withdraw without penalty or incurring interest. You may be tempted to add in your pre-approved credit lines. Don’t do it. Those forms of cash are debt. You want an honest answer for the baseline calculation of your cash on hand.

How am I doing?

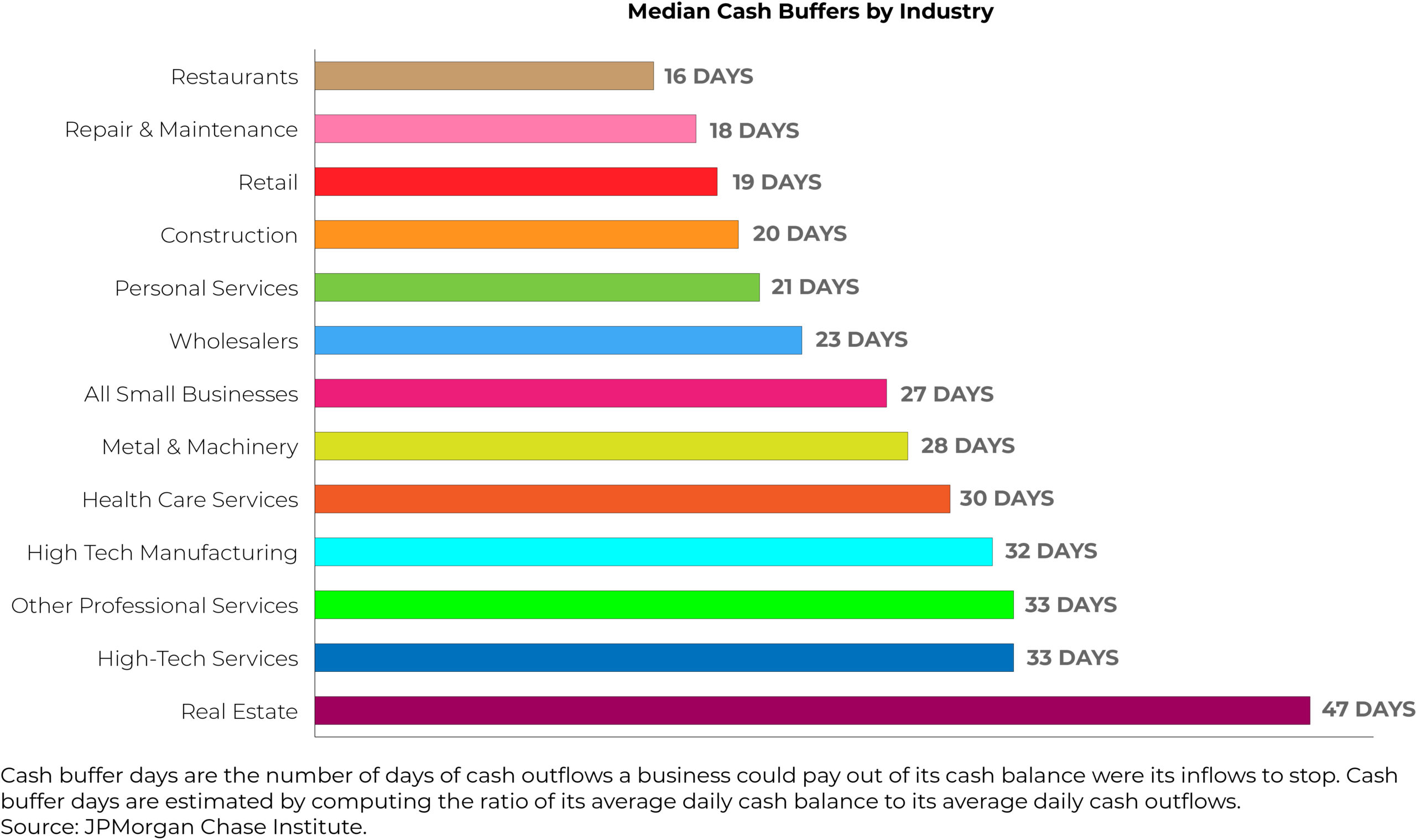

Is your number good or bad? The answer depends a lot on your business model. For comparison, restaurants typically generate high cash turnover and operate with low total margins. They typically report a median of 16 cash buffer days. The pandemic put incredible stress on these businesses and forced immediate layoffs in many cases.

Real estate agents, in contrast may wait many months to receive a large commission. They must stretch their savings over a longer period of time. As no surprise, most real estate agencies report a cash buffer of 47 days.

I would expect that most insurance agencies’ cash flow analyses look more like real estate firms. If you run a practice that relies on a seminar selling system that stretches over three months, your cash buffer days may exceed 50 days. In contrast, if you work in partnership with a local bank and sell fixed annuities to retirees over the phone, you may only need 20 days of cash buffer to operate effectively.

If you have a CFO, he or she should tell you that your ideal number of cash buffer days should be long enough to avoid having to use a short-term credit line to make payroll and pay expenses. It also shouldn’t be so long that you struggle to pay your personal expenses.

How do I improve my cash position?

As I mentioned in the beginning, the rule for improving your cash position is ridiculously simple: speed up money coming in the front door and slow down money going out the back. Practicing this requires a lot of attention, discipline, and very consistent management action.

Slow down money flowing out

First, slow your cash flow by cutting costs. Some expenses will automatically end, like client breakfasts, lunches or appreciation events. Others may require some painful steps or long conversations.

If you have a support team, salary and health care costs may be your single biggest non-marketing expense to manage. You probably depend heavily on their support and have long-term relationships. Short of layoffs, you may need to consider cutting hours or asking for reduced compensation. If they have insurance licenses, you may be able to offer variable compensation tied to sales. Rent may be your second largest expense. If you have a landlord, communicate directly and honestly about your financial state. It’s possible they will reduce rent or defer payments rather than lose a reliable tenant.

Depending on your business model, advertising, marketing, or leads may be the next largest expenses. Reach out to any software as a service provider and ask for modifications to your terms. Explore if they are offering short-term discounts or even suspension of billing to help their clients survive in this market. At a minimum, ask for an extension of payment terms.

Finally, remember to call your phone and Internet service provider. You likely have the time now to sit on hold and negotiate the terms and price of your contract.

Speed up money flowing in

First and foremost, start working with the carriers you trust most during this period so that you can confidently submit business that consistently places and quickly pays commissions. However, you will want to work with enough carriers to mitigate the risk of inevitable pricing or underwriting changes. The carriers you select should have robust digital capabilities today and not be playing catch up.

Waiting 10 vs. 30 days to receive a commission payment will have an incredibly positive impact on your bank account. In the next few months, speed depends on using the e-app capabilities of the carriers and working closely with their new business departments. You should expect real-time text alerts, online chat, the ability to upload documents, and on-line payment options for clients.

See which carriers offer value-added benefits or services that can help you speed up your cash flow. Depending on your new business volume, you may be. You may be eligible for accelerated payment of commissions, special marketing assistance payments, or even free leads.

What’s next?

If you follow these steps, you should have more cash buffer days to protect your practice and start to again grow your business. Take this week to go through your financials. If you have an accountant, ask them to help. If you belong to a mastermind group, lean on the members for creative solutions to strengthen your financial position.

Next week, we’ll focus on creating a top virtual experience when meeting your clients on screen.

SAYBRUS NEWS

SAYBRUS NEWS

Recent Comments